Episode #136 Bridging the Gap: finding truth, reconciliation and climate justice with Saurav Roy

If we have ten years to stop carbon emissions, how can we both rein in the power of the global finance and heal the damage done to the globals south in ways that are meaningful? Saurav Roy is an ecological economist whose work focuses on healing the north/south divide.

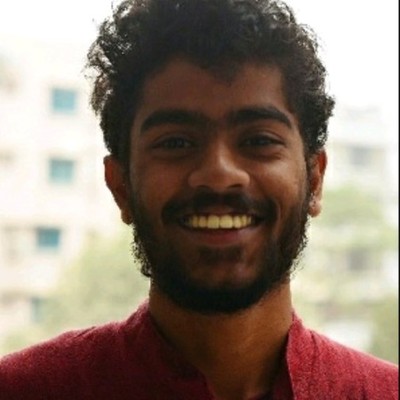

With a track record of founding startups at a young age, and executing entrepreneurial roles in global non-profits, Saurav Roy was selected as one of the youngest Global Shapers by the World Economic Forum at Bangalore in 2017. Since then, he has studied for a Masters in Regenerative Economics at Schumacher Collage, and is now working for the Carbon Tracker Initiative, a London-based, independent financial think tank that strives to influence the nature of global finance, away from stranded fossil fuel assets. It has cemented the terms ‘Carbon bubble’, ‘stranded assets’ and ‘unburnable carbon’ into the financial lexicon.

Saurav’s Master’s thesis focused on the ‘just transition’ elements of the Green New Deal with the realisation that ‘everything would change and everything would stay the same’ in terms of the balance between the global north’s endless consumption at the expense of human dignity, ecosystem annihilation and cultural balance in the global south. He examined the lack of supply chain justice in the existing concepts, evolved radical, inspiring ideas of how a global token system might fund non-debt-based climate reparations, and created the idea of a ‘Carbon Truth and Reconciliation Commission’ – because not all climate devastation can be healed simply by throwing money at it.

In this inspiring, thought-provoking episode, we explore these ideas in depth, evolving ideas and questions for COP27 and learn Saurav’s three core concepts for healing our times.

In Conversation

Manda: My guest this week is an astonishing young man, who is at the forefront of finding that flourishing future. Saurav Roy trained as an economist at Schumacher College in the years after I left and when I was still teaching on the faculty. His research dissertation there focussed on demonstrating what a global south centred Green New Deal could look like, using case studies of concrete policy and movement frameworks committed to anti-imperialism, agro ecology, SDR expansion (which we will talk about in the podcast),technology transfer and Climate Debt Reparation. Since then, Saurav has joined Carbon Tracker Initiative, which is a London based not for profit think tank, which researches the impact of climate change on financial markets. In the belief that the critical levers of power rests with the financial institutions and that if we can change those, then we can change the trajectory of the whole of our global governance system. And before that, because he has a track record in founding Start-ups at a young age and executing entrepreneurial roles in global nonprofits, Saurav was selected as one of the youngest global shapers in Bangalore in 2017 by the World Economic Forum. He really is one of the rising stars at the forefront of ecological regenerative economics. So people of the podcast, please do welcome Saurav Roy.

Manda: So Saurav Roy, welcome to the Accidental Gods Podcast. Where are you and how are you this morning?

Saurav: Thank you so much Manda for inviting me. It’s so lovely to see you after a long time from Schumacher. I am right now sitting iLondon in Greenwich and looking at the sun and enjoying my first summer here in this country.

Manda: Fantastic. Because after Schumacher, you joined Carbon Tracker, is that what it’s called, Carbon Tracker InitiativeSaurav: That’s correct. That’s called it’s called Carbon Tracker Initiative.

Manda: So tell us a little bit about that and what attracted you to it when quite clearly with your CV you could have gone to do an awful lot of things?

Saurav: Yeah, it’s a very good question, Manda. After Schumacher and studying economics, regenerative economics, ecological economics, I was really drawn into areas where we could contribute in fixing this climate crisis. And one of the areas I was looking at was finance; the supply side. How does the money system work that is fuelling these carbon emissions? And carbon tracker is obviously that popped up and what drawn me into this organisation was its founder, Mark Campanale. I’ve been listening and hearing him even before Schumacher and a synthesis.. he essentially is someone who studied agricultural economics and I spent a few years working in that area before moving into what they call the city side, working in the city and working in that area. He wanted to see how can he change the financial institution that can respond to this crisis. guess what I’ve understood from him, working with him, he has a very strong belief that one of the critical levers of change where power resides is finance. And if we can change the way finance works, it is a critical way of changing power. And that’s where his fundamental beliefs are. And that led to the creation of Carbon Tracker that basically popularised two critical terms, which is called carbon bubble and stranded assets. Which is essentially looking at how how risky it is to invest in fossil fuel, not from a model standpoint, just from the aspect of financial standpoint. And it is using their language and using the leverage called risk to make these institutions change.

Manda: Okay. So we’re looking from the perspective of financial people who speak an entirely different language and have a very different mindset. Most of them are not concerned about the climate and ecological emergency at all, as far as I can tell. And so what, if I’ve understood what his plan was, was to make it clear to them that investing in fossil fuels was just not financially sensible in the long term?

Saurav: Absolutely. Absolutely. And a big chunk of these embedded emissions in the stock market, the one of the reports that made carbon tracker become carbon tracker was the unburnable carbon report that published in 2012, which essentially looked at how much embedded carbon emission exists in all these stock markets. And he did the math for it. And if you burn all these reserves of these companies, where would it fit with the carbon budgets? That was the number was given during 2012. That where does these two numbers lie? If the carbon budget is this and if the embedded emissions in the stock market is this, there needs to be a correlation. And if what we have embedded already in the stock market is way more than the carbon budget, then there is a risk of stranded assets. Meaning that you have all these assets which are being financed, but it cannot be burned because the science disagrees that you can’t burn them all.

Manda: But that assumes that the people in the stock market care about the science. And we know that the, I think the sustainability head of one of the big banks, recently said, you know, it doesn’t matter if Miami is five metres underwater because it’ll only effect the GDP by 0.2%. So we should carry on burning carbon anyway. Which is clearly functionally insane. But if they don’t believe that the carbon needs not to be emitted, then they’re not going to take on board an argument that says these are stranded assets. So has it worked? Do more people take it on board than would seem likely?

Saurav: Has it worked? It’s a good question, right. And it definitely has penetrated, the concept has penetrated within the people of the financial institutions. Stranded assets is a term that is used a lot: Carbon bubble. So it has penetrated the imagination of this institution. Mark Campanale using the reports. So it has captured the imagination of these people. But has it really changed the financing of the fossil fuel? We recently released a report; I would really encourage if you speak to Mark, and I think he could expand on some of these concepts. He’s more of an expert in this. But to just to share a bit, a few examples, the recent report that we did in 2022, we released last month, which is a ten year update on the first report that came out, the unburnable carbon. And we found that there are 40% more fossil fuel finance than ten years before.

Manda: Oh dear.

Saurav: So in the last ten years, we have financed 40% more. So what does this mean in terms of maths? So ten years ago there was 2800 gigatons of CO2 emissions embedded in these stockpiles. 2800. And what was the carbon budget? 886.

Manda: Oh my goodness. So that’s an order of magnitude difference.

Saurav: Yeah. And that was ten years ago, right? Today it has increased 40%, which means there are 3700 gigatons CO2 embedded emissions. And what is our carbon budget today? It’s 360. So there is ten times more in the reserves than what we can safely burn to limit 1.5. Right. So. So definitely the math doesn’t work. One of the reports, I guess the recommendation, was 90% of this is unburnable. Because to maintain the carbon budget, you cannot burn them all to remain in that budget. So to ask has this work captured? It has kind of penetrated, but has it really led to action? I don’t know. Because if this work didn’t happen, maybe it would have 80% more, right? So that’s helping. And just to kind of maybe expand on this one last thing, which is the carbon bubble, right? When we think of this 3700, it’s a huge bubble. And if you think of the 360, which is the carbon budget, it’s a small bubble. The extra bubble which we can’t burn is essentially the bubble that we are talking about, which is a financial risk. And if that needs to be written off, it means $100 trillion is just gone. So there is a risk of what we call that; that’s essentially the concept of carbon bubble.

Manda: Wow. $100 trillion gone.

Saurav: Yeah.

Manda: Wow. So because I became quite a functional sense of an economist, my answer to that is, okay, just write it off. It’s money. We make it up. It’s an idea. Why don’t we just have a different idea? But people who work in finance get terribly upset when I say that, because for them it’s not an idea, it’s a concrete reality. So within Carbon Tracker and I completely get that you’re fairly new here and probably bedding in and still finding your feet. But is there an idea of how to rescue that 100 trillion so that it doesn’t crash the world’s economy?

Saurav: There is ways, I guess. To go about it is working with these financial institutions, regulators and policymakers to talk about transition. Is how can we take this money out and not finance more new oil rigs? It needs to stop now. There is no justification of finding new oil reserves, because if already the 90% what is there is unburnable, why are we looking for more? It’s pointless, right? So there is the fight to stop finding new ways to drill, right? So that’s one. The second way is, I guess, working with these financial institutions to, I guess, write down some of these assets, what you call fixed assets, which are essentially these rigs and areas where the oil are being pumped and when there are these flows which are pipelines. So essentially kind of writing it down, to slowly move the money from these areas to more renewable sectors would be one way of doing it. There is another lever which I feel is not much talked about, which I guess my colleagues at Carbon Track are doing really well. It’s called around decommissioning. There is a huge cost in decommissioning some of these areas of extraction. And if we can make these companies pay up for these decommissioning costs, some of their business model will fail to exist. And once their business models kind of collapses, people will automatically move towards renewables. So there is this detailing of working with regulators, policymaker and financial institution, which I think Mark could explain a bit more.

Manda: Okay. Yes, definitely. Because I’m looking at what’s happening. For instance, Biden at the time of recording last week, he just announced more oil exploration. As far as I can tell, the UK is busy financing more oil exploration. And you’re right, it doesn’t work on any level, but they don’t seem to get that and I’m interested in how we make them. So let’s yeah, I would definitely like to talk to Mark. Let’s park that for a moment, but let’s just do a little bit more of what you’re doing within Carbon Tracker, your research. What is your area and where is it going and how would you like it to pan out?

Saurav: Yeah, I work as an associate and my areas are twofold work areas. Number one is a lot of my work is very horizontal, since our focus is oil, gas, coal and climate risk disclosure and also decommissioning, my work is essentially working with senior leadership and management to figure out ways of how are we measuring some of our research. The ones we kind of commissioned, some of our research, how do we make sure that some of the research we are doing, how are we measuring the impact of the intended impact? The metrics of how, let’s say, we are doing a report on coal or oil, how are we making sure that just putting out a report is not enough because it’s not an academic institution? Right. It’s also like moving one step forward and then trying to convince and change mindsets. So how do we measure some of these areas? So that’s one area of my work, is figuring out impact metrics and frameworks of figuring out if the research what we are doing, is it actually changing anything. So that’s one.

Saurav: And the second one is around fundraising. It’s institutional of how we make sure there is enough in grants and funds to continue carry out this in-depth analysis, which is very neutral and apolitical.

Manda: Who might offer fundraising? Because I’m guessing it’s not right wing political parties. So the right wing think tanks all seem to be funded very heavily by the fossil fuel industry. You don’t have a kind of anti fossil fuel industry. Who is likely to be funding?

Saurav: It’s essentially philanthropic. And I’ll give you some numbers which will kind of surprise you. Out of all the philanthropic funding that has gone globally around 750 Billion in 2020. Only 2% goes to climate. And that is a mad number isn’t it.

Manda: Where does the rest go? Are we talking dollars? I’m guessing everything is always in dollars. $750 billion, of which 2% goes to climate. So that’s…

Saurav: Climate crisis. This is mitigation and adaptation together and that’s crazy. A big chunk goes to health, of course. So then education and climate gets less funding than arts and culture. I can send you the McKinsey report and the ClimateWorks report and it’s a mad number.

Manda: Is this because they just don’t get that extinction means no more arts and culture or or is it that somehow it’s okay to fund arts and culture…I’m guessing super rich people talk to other super rich people and they want to be doing stuff that seem to be cool.

Saurav: Yeah, well, I don’t know. I think it’s maybe something to do with the way these philanthropic institutions are kind of started off. But I think things are changing. After IPCC 1.5 degrees, COPs 26 and 25. This sector is growing very exponentially, right. But not at the pace where it is needed, right.

Manda: Okay. So you’re busy chasing the 2% along with everybody else who is busy chasing the 2%?

Saurav: Yes, absolutely. Essentially fully philanthropic funded. And we rely on grants, which is a different fund as European American and it’s very, I guess, research focussed work. Yeah, I guess every conversation starts with a bit of gloom and doom and it does, right, but there needs to be like pockets of hope and I thought to kind of give out some sort of pockets of hope within this numbers that I just shared around carbon bubble, right? Yeah. Because it is a very heavy subject to kind of talk about and there is no escape around it. But there is a bit of optimism around the growth in these renewable sector. But in terms of optimism, what we should be looking at are the patterns the world is heading. And one of the ways is today to two terawatt hours of electricity is generated through wind and solar. That is global generation, right. This is growing 20% per year. Which means in 20 years, this growth will take over the fossil fuel generation. So 40% of the world’s electricity can come through wind and solar if the rate with which this renewable sector is growing. So in 20 years, we will see the fossil fuel company; if you look at these graphs, the graphs is usually a big chunk fossil fuel and small chunk renewables, and this graph will suddenly start to become the other way. And that’s the pattern to which we are going. So there is hope in terms of the way we are progressing. The question is always how quick.

Manda: Yes. So as an adjunct question to that: is 20 years fast enough? But I guess is it exponential growth? Because 20% per year static is one thing, but if it’s 20% per year and there’s a kind of incremental increase in that, then I would think ten years you begin to hit singularity.

Saurav: Probably, yeah. And the answer to your question is 20 years quick enough. I like looking at the science. I don’t think it’s quick enough. We have ten years, but that’s the best we could do. Let’s get that done and then see where we are.

Manda: Yeah, yeah, absolutely. It’s better than nothing at all. And that graph, I would think, would make an impact with the money men in a way that 1.5 degrees probably won’t.

Saurav: Yeah.

Manda: So that has to be a good thing. Yeah. Okay. Bright spark. That’s that’s cheered me up. So, you wrote your dissertation at Schumacher on the Green New Deal and essentially the problems with it and how it could be improved. So let’s move over to that. Not necessarily that I think Biden is about to implement the Green New Deal, but let’s imagine a world where Saurav Roy gets to tell the people in power good ideas, give them good ideas. What good ideas would you give them, if we were going to actually really throw ourselves at a global solution for the climate and ecological crisis?

Saurav: Yeah. Thank you for asking that question, Manda. And this is something that I’ve been thinking about during during my dissertation year, where there was a lot of proposals being put out to kind of decarbonise and make the economy recover. This was during pandemic, so there was a lot of economic recovery conversation happening. And I picked up the most important, I guess, progressive bill or legislation I could find, which was Green New Deal. The inception is around 2007/8 when Anne Pettifer kind of sat together with friends in Baker Street in London and then thought to kind of draft something new, that’s going to decarbonise and put economy at the heart; which is workers, new jobs, employment, all that conversation, right? Ten years, nothing happened. I think after 1.5 degrees when it came out, the IPCC report, thing started to pop up again and Ocasio-Cortez kind of popularised it. I started reading this legislation and I couldn’t wonder and I couldn’t stop wonder, that it sounds really amazing to read all these stuff. But coming from India and I’m living born and brought up there, it sounded like that everything will be changed, but nothing will be different from where I was sitting.

Manda: Right. Right.

Saurav: I’m like a big fan of Ocasio-Cortez, a big supporter of Bernie, right. But it still didn’t kind of see what was happening to global south countries in all these amazing proposals, even though the US still hasn’t accepted some of these stuff. It’s only accepted in European Union, which is called the European Green Deal. So I can understand how tough it is to go through some of these areas to kind of pass legislation. So to kind of have that conundrum question; everything will be changed but nothing will be different, was a part of my argument. And how do we change that? So I started dissecting all the different proposals of Green New Deal. There are like six or seven now. There is like Ocasio-Cortez there. There’s European, there is Bernie Sanders, UK Labour Party, South Korean, Australian Greens. Different versions, right. And it is good to have different countries will have different ways of tackling this. There are some things that were never addressed from the south perspective, which is becoming a bit more more nuanced. The first one is there is a strong inclination of using a Just Transition, from a very nation state border perspective. When they talk about a Just Transition, they can only talk about what’s happening in their country, right? When Bernie talks about a just transition, it’s happening to the workers in the US. Same in Europe. There is a huge inclination towards carbon sequestration, CCS offsetting technologies, which I found very eco modern and I don’t think that’s a way to progress. That’s not my personal inclination to kind of go. So that’s second.

Saurav: The third one was, it was a race to become green giant. It was this European nations or American that who could be the next green messiah? Who can take us through this crisis. I wrote something down from the European Union that says “climate change and environmental degradation are an existential threat to Europe and to the world. To overcome these challenges, Europe needs a new growth strategy that transforms the union into a modern, resource efficient and competitive economy”. Right. So I guess if you work in these places an institution, you have to speak similar neoliberal languages. But there was a conundrum there. And on this one hand, there was this green growth or like this growing this economy into crazy level. And then there was this question in my head, where is this stuff going to come from? Right. And there was no conversation about supply chain justice, which was part of my dissertation thesis. That how can we make sure that there is this expansion which is predicted? And this is very new stuff, by the way. There is more and more literature is coming out, that the World Bank released a report in February 2022 that there’s going to be a 500% increase of mining to meet the global demands. 500%.

Manda: Of mining of what? Of rare earths?

Saurav: Rare earth minerals, cobalt, nickel. My country, India, exports aluminium. I don’t know a lot about aluminium, by the way. Copper and all of that. So all this stuff needs to come from somewhere. Like if you study world systems theory and global economics, you know, all this stuff is going to come from south. A big chunk of it. So my question was, why doesn’t GMP address the supply chain justice? So that was one critical, if you tell me what needs to be included in these European deals. Or a Green New Deal. The hard focus of how can we make sure of the supply chain is at the heart of this strategy. So that’s one. The second one, which kind of addresses in Green New Deal in the European context of Bernie Sanders way, but doesn’t really in the American way. Which is the loss and damage problem; you can call it reparation. Which is more respecting the environmental movement, during the seventies it was all about reparation and climate debt. You can use that language, but essentially it doesn’t address the loss and damage issue. I was looking at the numbers of the loss and damage issue and it was coming to something around… India or Global South countries will spend around one point something… Around $1,000,000,000,000 by 2050 on loss and damage, right. And that’s a huge number. And the only way, I guess, I don’t know how will we finance some of these flashfloods and stuff? So to address this reparation and loss and damage, there isn’t a mechanism to transfer some of these wealth.

So these are the two aspects: one is around loss and damage was a big focus. Second was supply chain justice, was a big focus because there’s going to be increased mining. And the third one is something I don’t know, this came out of my dreaming, which was, you know, in loss and damage. I’ve worked in Bangladesh in climate prone areas. And some of the things I saw, the people, the things they have lost: it cannot be paid by a cheque, no matter how much it is important to transfer the wealth or help these communities to kind of thrive. And for that, these are areas of prayers. These are areas of childhood where they grew up that cannot be fixed with money, but that you need what I call Carbon Truth and Reconciliation Commission, which is a place of archiving stories for climate induced pain and violence. And I thought it could be, this is something I think I learned from the apartheid movement in South Africa and the Nazis, the post Nazi kind of healing process in Germany. There needs to be an archive of what climate induced pain feels and looks like, and that stays with us. And there is no archival process right now, of sharing that. So I think it was that which I kind of wanted to stress upon; that there needs to be some sort of a way for these communities to come together and heal and share what salination of their water has done to their communities and what agricultural loss really means. Because some of the stories are with me, but I’m sure there are countless that could be compiled.

Manda: Yeah. Has anybody picked up on that within carbon tracker, within any of the philanthropic, I don’t know, whatever they’re called, entities that you connect with? Because that feels so big and so true when you say it, it’s obvious. And have you managed, have you got any traction on that?

Saurav: Everyone likes the idea of reconciliation, truth and reconciliation. Jonathan like that. You know Jonathan from Jamaica.

Manda: I do. Jonathan Dawson Yes.

Saurav: And I wish I think you would be seeing some of that in Arts and Museums. And I am trying to work on some of these exhibitions, bringing out these stories of what sea level rise… Doesn’t mean anything, unless it changes the way you do farming and then how it changes your wedding in parts of Bangladesh. So these very human stories, when it comes out, it bridges a gap between north and south. Not only this, even north and south India, Bangladesh, there’s a lot of tension happening around climate. How can we bridge some of these gaps? And these stories really help these, right. These are intricate stories. So that’s one I think I’m trying to kind of find ways to kind of use my networks and trying to get these stories out. And it’s something I would do without even money, the kind of constantly archival process. The second one, I think, in terms of supply chain, is something that that I’m getting more and more into. And it’s something I’ve been trying to think a lot about, trying to kind of address this from a nation, India perspective, South Asian perspective. And I have some ideas which have been throwing around with some of my friends I know. And then we are trying to build some projects around it, but it’s not at a stage where I could share more about it yet, but it’s in the making.

Manda: But this is all predicated on a growth economy, which is functionally insane. And is this because Ann Pettifor, who’s an amazing economist and I have huge respect for her, but she’s a very old style economist in many ways. Was she just locked into a growth paradigm or did she feel that she needed to have a growth narrative because otherwise basically nobody is going to listen?

Saurav: Yeah, I think the latter. I’ve met Ann Pettifor recently in one of the conferences and I asked her similar questions around growth. And I think this, you know, when people enter into the stage of parliament and government they automatically have to put up a skin to kind of talk, and in a way that you could be listened to. So I think they quickly put up this way. If you ask someone individually, do you think economy needs to grow as much as they can? It’s like a pointless question, right? Can you have more mangoes in a tree than the trees can produce? Nobody will say yes, right? It’s right. But I don’t know. Somehow this culture, within the air within these institutions, are in a way that you are not allowed to use these words. So maybe it’s to kind of convince and get the word across, you need to have compromises. And any social entrepreneur would agree that to win a war, you need some wins, a few battles and then move on and then move to the next stage. So I think that’s where in terms of I think Ann Pettifor kind of moves, that there needs to be a growth but she is very critical on the growth strategy as well.

Manda: Yeah okay. Because the whole supply chain, this idea that it’s going to be 500% increase in mining is..

Saurav: Insane.

Manda: Just devastating. Yeah. And insane. And it seems to me… I don’t understand how anyone can equate that with even attempting to keep the idea of 1.5 alive. And that’s a whole argument in itself. There are a lot of people who say it’s already gone and it depends when you started measuring. But let’s let go of the numbers for a minute and just assume that we’re trying to create a flourishing planet where we exist in some kind of balance within a world that is still alive. You can’t do that with a 500% increase in mining, in the same way that you can’t do it by burning all of the stranded assets of the carbon. And I was very struck by the numbers of a trillion round numbers being spent by the Global South to try and mitigate climate damage. While the people in the fossil fuel companies are presumably weeping buckets at the idea they’re going to lose 100 trillion in stranded assets. And that somehow, is anybody at a global economic level, looking at the ways we can shift the whole balance of how money is shared? Because even that number, it’s 1% being spent on trying to heal people’s lives while the fossil fuel companies are weeping over the fact that they’re losing 100 trillion of money that didn’t exist in the first place as a concept. And that means, therefore, I don’t know, they can’t buy another super yacht. And the inequity of that just seems to me to be fundamental to the question of how do we rebalance the world economy? And I realise this is an extraordinarily big question, but have you given time to thinking about the ways we could do that?

Saurav: I have one idea. I’ve shared this.

Manda: Yay! Go for it.

Saurav: It’s something I thought to kind of expand on. How do we change the world balance? I don’t know. It’s a huge question. People, the big thinkers, economists have been thinking about it. Right. In terms of how do we address this quick issue of rebalancing some of these loss and damage issues? There is this idea of SDR. I don’t know if you have heard it’s called Special Drawing Rights. It has been used four times since the IMF. Imf, it’s not a currency, but it’s kind of like you can think of it as a token, that IMF gives to the member states. And the last time it was used was for the pandemic recovery, which is around 650 billion. The way SDR’s are distributed are very of a North-South or colonial way, which is the bigger chunk of the economy, the bigger SDR tokens you will get, kind of right. So America gets a big chunk because it’s a bigger economy, Europe, but they don’t need that much because in COVID, COVID was really badly hit in global south country, so they needed a bigger chunk. So there’s a bit of that. But people are working really hard to change some of these sharing processes. But essentially you can use these SDR mechanisms, which is Special Drawing Right mechanism, to fuel some of the climate action work.

Saurav: This was first proposed by this amazing lady, the Prime Minister of Barbados. She’s this fierce, powerful lady that you don’t want to fight with. And she put out that because, you know, some of these actions, some of these funding, sometimes southern countries, let’s say Tunisia or in India, they take loans and these are sovereign debts and they become super indebted for that. The beauty of SDR is nobody gets to be in the debt. Because sometimes, let’s say you are one country, you get some SDR, you can liquidate that SDR into some sort of a currency that you can use to fuel some sort of action. The definition of getting the SDR is that there is a global need for long term crisis. That’s the kind of predicament of the inception of SDR. And if there is that definition, then I can’t see anything more important than this, to fund loss and damage without taking loans. To fund climate action, which is, I guess, renewables, energy, all of that. Right. And you can do that. And there are economists working. So SDR could be a way forward in at least next ten years. Let’s experiment in the next ten years. How can we use that currency and then move, quickly make some changes happen? Yeah.

Manda: That’s really exciting and I cannot think why I haven’t come across this before. So let me just step myself through this and make sure I’ve understood. Under normal circumstances the dollar is the current global currency and the IMF and the like would offer loans which were created because they would have a debit and a credit side and a balance sheet. And we’ve made $1,000,000,000 and we’ve given it to you, but basically that’s a debt. And we’re charging interest. So we’ve made money out of nothing, we’re selling it to you at a profit, and you’re going to be forever a debt slave to us because we’ve given it. But these SDR’s are we’ve made money out of nothing, and we’re just going to give it to you. And are they giving it in dollars or are we creating a whole new currency here that is not linked to the US dollar? Because that sounds actually quite revolutionary.

Saurav: I don’t know exactly the whole mechanism I’ve been trying to get my head around how does the whole transaction work? But essentially the IMF gives out these SDR in, you can call it as like, let’s say tokens. And one of these countries who gets it, can exchange it with a different country, let’s say US or Japan.

Manda: Right.

Saurav: So when they give out that tokens, they get something in return, which is the currency that belongs. SDR in itself is not a currency, but you can exchange it in form of currency, which is amazing, right?

Manda: Yeah.

Saurav: And this is used during COVID recovery and 650 billion, which is the largest it got given. Before that it was, of course, you can guess, was during the financial crisis. And that was again, it’s during these crisis that it is being used. And I think my dissertation kind of urge that, guys, let’s just do it now, you know?

Manda: Yes. Yes, I’m I’m… All my fuses are blown because this is essentially, first of all, we’re moving the global hegemony of finance away from the states. Someone in the IMF has gone we don’t want the dollar to be our primary communication of value transactions anymore, and we’re not going to create a negative balance.

Saurav: Exactly.

Manda: That is potentially….

Saurav: It’s possible.

Manda: If somebody could now run with this, it could change the entire global financial structure. Because you could wipe out… You could give India tokens to the value of the trillion.

Saurav: Yeah.

Manda: And and you’re right, I absolutely hear that there is no number of tokens that you can give someone whose land has been contaminated and they can never live in it again. There is nothing, no number of tokens that will recreate the oceans if we completely kill all life in the oceans, which seems to be quite likely within the next decade. But if we could create tokens such that a dead whale is no longer worth more than a live whale. And dead land that is now no longer able to have anything done with it; we accept that it’s gone but we can then somehow find more land for you. And yes, your entire culture was based on this land. But everybody around the world is going to have to change their culture in some way, I think, as a result of this. So we’re going to collect the stories of the pain, but then build new stories of rebuilding and of what rebuilding looks like and what can we save and what do we want to save? Because I’m guessing that everywhere around the world ther’s bits of culture that we’re all quite happy to let go of. And there’s bits that we really want to sustain. Let’s protect educating our girls and get rid of the bit that says they’re not allowed to go to school, for instance. And see what we could build. It feels really exciting. I’m incredibly impressed. So the next question is, who is picking this up and running with it? Because there must be somebody.

Saurav: Yeah, there are very leading economists. Some of the economists. I do like to follow Jayati Ghosh. She has been talking about this. She’s this, again, Indian fierce lady. Another Indian lady you don’t want to fight with! One of my favourite economists. She’s been talking about this during, you know, the vaccine problem where the North has had more access other than countries, has been using some of these very interesting models to kind of find ways, give solutions of how this can be done better. So she’s been leading that work. The people at the COP, I think it has been kind of slowly getting captured in the imagination, that it’s been used for COVID. How can we use it for climate action? And we’ll see that in COP 27. Because in COP 27, one of the ways, one of the central issue is going to be how do we create a mechanism for these loss and damage reparations. It is not any more about does South deserve the money. It’s been quite… The science is quite…

Manda: How can we do it, rather than should we do it.

Saurav: Yeah it’s question is mechanism. But in COP26 somehow the United States and other European nations found a way to accept that it was their historical embedding. But they create a language, in a way that it does not mean it would be legally compensated, because as soon as you have that in wording, it means all these countries will apply. So they somehow figured out a way to not get into this legal battle, but somehow they’ve accepted it. So now it’s more about the mechanisms and 27 is going to be at the heart of this mechanism.

Manda: And that’s this autumn in Egypt.

Saurav: Yeah.

Manda: So I’m beginning to understand why the IMF has possibly done this, because perhaps I’m being wicked to the IMF. But if we can create tokens out of nothing that are not dollars and give them to you in reparation, then it’s not coming off the balance sheet of our own economy, which we would have great difficulty selling to anybody to the right of Jeremy Corbyn. Basically.

Saurav: Absolutely. I said that it’s a win win strategy and I still don’t understand why people are not doing it.

Manda: Well, no, except so this is very interesting because my economist brain is going okay, inflation. And I have a theory of inflation that it has nothing to do with creating money and everything to do with scarcity of stuff. But if we’re looking at reparations, the stuff that is scarce is land to live on. That we’re going to let you because we otherwise we might be mining on it with our 500% increase in mining. And we don’t want to give it to you because hey, there might be minerals under there. So land is a finite resource. If we create an infinite number of tokens, then the cost of land becomes infinite. So we have to find a way for that not to happen, don’t we? We have to somehow create ceilings, internationally agreed ceilings for cost of things in numbers of tokens. And then we’re heading at International financial governance, which is first necessary probably, but also quite scary because it depends who’s running it. And I don’t want the heads of Enron or Shell or any of the other huge, huge mega companies that are currently running the world’s finances to be running this. So Saurav, how are we going to create the revolution that takes over the creation of these tokens and makes sure that it’s actually equitable? If you, again, if you were advising and they were listening to you, how do we dish them out in a way that doesn’t mean they’re just accumulating with the people who already have a lot of dollars? Does that question make sense?

Saurav: Yeah, yeah, yeah. Let’s make this a central topic within COP 27. How do we get the mechanism right? Because that’s a place where a lot of these financial institutions, representatives are there. When we have them, catch them where they are in the gathering and how do we get the agenda forward. This is a mechanism that can be used. Since all of you guys are happened to be in this room. How do we find a way to do it?

Manda: You have kind of nailed the question accidentally there, is that it’s likely all to be men and they’re likely to be 90% white and their their concept of getting the mechanism right- So I may be projecting my concept of the kinds of financial people who are controlling the world’s finances- but I watched what happened after COP 26. And at COP 26 there were a lot of people gathered. But the sum total of people from the fossil fuel companies was greater than everybody else put together. And within three months, a petro state has launched a war that allows them to hike the price of fossil fuels exponentially. And I watched the financial papers and there was a great deal of, oh, you guys had all divested from fossil fuels. How sad. Don’t you think you’d better reinvest now because the prices are going up, and that’s the only way to get your money back and I don’t think that was an accident. There’s all those fossil fuel men get together and within three months, their industry is looking very bright from a financial point of view. It’s looking catastrophic from a global point of view, but they don’t care. And so we’re going to get a similar, I would suspect, bunch of people together at COP 27. We can ask them, how do we get the mechanism right? And their version of right is going to be we stay in power. And actually, I think that needs not to happen. So have you got – could we, you and I, create a mechanism that would balance the power?

Saurav: Yeah. If you get the mechanism right, it’s so top down Manda these institutions. Right. To move these institutions. That the kind of level of determination and movement that is needed to kind of move this institution has to be from the top, right. Unless there are ideas to do things at a local state level, I do believe.

Manda: Unless we can create a global revolution, basically.

Saurav: Yeah, exactly.

Manda: Like bottom up.

Saurav: Yeah. Like I do like to think these very top down big ideas, right. But when it comes to work, I do work in local economies, local. That’s where the kind of spots of regeneration and abundance you can create. But always kind of the North Star is there. They have to move as well. Right. And. Yeah. Sorry, I don’t have a very good answer of doing.

Manda: Okay, but maybe just asking the question. You know, I firmly believe that asking a question is a political act and maybe just asking that question and holding it open and seeing what the accumulation of answers are. If you were to ask a Bangladeshi farmer, you would get a different answer from if you asked Ben van Beurden, who’s the head of Shell? You just would. And so and presumably if we asked these amazing powerful women, the Prime Minister of Barbados, we’d get a different answer again. So I wonder, is there a way to collect those answers ahead of cop. And take them as a this is a selection of possible options, that might be different to the options that you guys at COP are going to think of.

Saurav: That’s a very good that’s a very good inquiry. And we should write something about this. I think you’ve given me an idea to do something. Yes.

Manda: Yeah, because I look at Carbon Tracker and you have a lot of contacts amongst the people at the top of the hierarchical pyramid. And both of us, I imagine want there not to be a pyramid, but I don’t think we’re going to dismantle it in ten years and we need the answers in ten years. And so if we can persuade them that there are good answers, because I think these guys depend on profit and their minds work in a particular way, but they’re also human. They have kids and grandkids. And and I don’t believe they wish to see 98% of the human race rendered extinct within their lifetime.

Saurav: Yeah.

Manda: If we can offer them options that that could be seen to work, then they might run with them. So. Right. Okay, we have, we have a plan, you and I, let’s get going on this. And if you can get carbon tracker to somehow support this as an inquiry, then there is reach isn’t there to how we could get going. Because yeah. SDR tokens, non debt related finance, has to be the way forward.

Saurav: And supply chain justice. Mining.

Manda: And supply chain justice. Yes of course. But supply chain justice has to arise out of a financial system that doesn’t assume that mining this bit of land is the only way to make a profit out of it.

Saurav: Yeah.

Manda: How do you arrange supply chain justice? What are the foundations of your supply chain justice?

Saurav: Yeah, one is land use policy, at the heart of it. Is how do we make sure that where are we doing these sites? Right now a lot of data and information about these sites, even in countries like India, it’s very scattered. We don’t know where the mining companies, like we know, but it’s not very compiled and put together. The other thing I observed within India is the mining and the climate change work is not seen together. The mining is Geological Survey of India and climate change is very different, right? So somehow this has come kind of together, because it was built during the World War Two era and it was very different. And now it’s coming together, right? So we need to join these things together.

Manda: And we need to join them globally.

Saurav: Globally, exactly. Like mining is essentially a part of these data models of renewable, right? A lot of these renewable models built by economists doesn’t take the extraction process into their modelling, which is a huge carbon emission process.

Manda: Of course it is.

Saurav: Yeah. So we need to bring some of these aspects together. Information of these land is very, very complicated to get, especially in India. To kind of figure out where are these operation sites, who are these mining companies, what is their profit margins, what are the working conditions? Because there’s going to be, as you say, 500% increase in mining. We think about biodiversity, but we also have to think about labour exploitation. Because 80% of the mining people in India are not protected, as much protected, under the worker rights. So expansion of these people, what you can call new slavery, right? That’s what I call everything will be different, but nothing will be changed. It means that you are increasing their dollar income, but their dignity is lost.

Manda: Yeah, yes.

Saurav: Supply chain justice is at the heart of it as well. Yeah.

Manda: Right. So human dignity, ecosystem integrity.

Saurav: Yeah.

Manda: And, and it seems to me that the key to that is bringing these things together, but also moving away from just tracking carbon.

Saurav: Yeah.

Manda: Because it cannot be the case that an intelligent, let’s assume economist, gets together a system and doesn’t notice that in order to produce whatever amazing regenerative power they are wanting to create, there are a thousand more great big holes in the ground that are completely destroying ecosystems and enslaving millions more people into very short, very brutal, very deeply unpleasant lives with no dignity. That shouldn’t be allowed to happen, frankly. So we need to make a new economic system that says you don’t get to produce an economic paper unless you’ve actually tracked it all the way back to the beginning. I can’t believe that that happens. No, let’s take that back. I can believe it happens. I would just prefer to believe that it didn’t. If we’re going to move beyond carbon as our only index, because that does seem to me a problem of COP, a problem of a lot of the net zero ideas is we’re only looking at carbon. This is how the UK government can turn out agro ecological ideas where it’s actually more carbon effective to have industrial chicken million chickens in a place which then completely destroys the entire river system and the oceans. But somehow they’ve managed to balance the carbon slightly better.

Saurav: Yeah.

Manda: How can we find an index that people will pay attention to?

Saurav: Yeah.

Manda: That takes in to account the bigger picture.

Saurav: Yeah. You know what drew me to the Green New Deal was during Roosevelt’s work on passing the the New Deal, which was about not only figuring out rapid industrialisation, unemployment, there was a dust bowl happening in parts of US, which was about environmental stuff. And he said, and this is overlooked during when we talk about Green New Deal, is that he changed the financial system. He took back the gold reserves, right. If you remember. And he said the economy needs to reflect the American people’s condition, something along these lines. And if emissions and carbon emission and capturing that does not fix the condition of the planet, then it is not right accounting. And there is good frameworks. The Planetary Accounting, the planetary boundaries framework is a very good framework to kind of look at how well we are doing. It should be a very good report card of how well we are doing and I think lean towards that framework, is how good our water, air and all of that. So I think leaning towards that would be.

Manda: Okay and that’s out of Stockholm and they have the measurement systems in place and we can trust them on that.

Saurav: Absolutely. And I think Stockholm, they do a very good job in tracking some of these. I think if it can be kind of moved into very nation ways or like geologogical areas, where South Asia can have one and all of that. Because the northern countries have a very interesting way of outsourcing some of these and calling we are offsetting or like we don’t have carbon polluting. It’s classic, right?

Manda: Yes. And I have to say, they don’t just do it to offsetting to the global south. They offset it out of London. I live in Shropshire and they’re buying up perfectly good farmland in the north of Shropshire, ploughing it and planting rows of sitka Spruce and they produce more carbon in the ploughing to plant the trees, than those trees will ever sequester. And they’re taking Land out of farm use. And then they go, look, yeah, we’re offsetting. It’s all cool.

Manda: So we’re heading towards the end of the time. It seems to me there’s quite a big question and I am just throwing this out because it feels like there’s quite a generative set of questions that we’re evolving. Around the nature of nation states. They’re a relatively new concept in human evolution, and it has struck me increasingly recently that the political need to retain the functional boundaries of our nation states and for political entities to only consider the best options of those nation states is part of what’s causing the crisis. Have you explored or are there people exploring the ways that we could dissolve the nation state boundaries? Or do you think with your experience of being in India, Bangladesh, all of the quite rigid, you know, India and Pakistan, that boundary is a relatively new boundary, but it’s now a very rigid boundary. Do we have any hope within a time frame that matters, to start dissolving boundaries?

Saurav: It’s a very good question, Manda and I wish the answer wasn’t gloomy. If the answer was more global cooperation, if the answer was more looking beyond our passports and then going beyond that. But it is not. And it is something I would invite you to interview, I guess. Get him on the podcast: Jake Smaje. He’s been trying to study climate migration and how it is changing geopolitics. And there is a huge industry rising; more and more money is being put to create stronger borders, to recruit more people in border security forces. So the patterns of of industry is against the ideals of what we just spoke about. If we are to follow the patterns of this industry, then no matter how much amazing tweets we put out, or global cooperation conversation happens, when it comes to really people coming into your nation and asking to open the gates, our very Palaeolithic brain comes out for some reason. And that is not human nature. That is not intrinsic to our condition. There is a very interesting concept called the Gandhi neuron. It is actually a term, it’s actually an academic term. Yeah, I did not know about this, I found out during my research. That he had this friend called Kumar, who was an economist, and he had this concept that humans are not rational self…

Manda: Rational self interest

Saurav: Self-interested group. Because he kind of said that we have this intrinsic value of sharing and doing. So we have this neurone condition which the neuro neuroscientist gave the term called Gandhi Neuron. And it is not intrinsic. But if we can have more cooperation, especially in South Asia, I am very closely I’m a very political person. And if India had more cooperation with Nepal, Bangladesh, Pakistan, Sri Lanka and kind of come together, be like, guys, the droughts can hit all of us, you know? And if it raises more than two degrees, all of us are going to suffer. Right. And so the problem is not just North-South. The problem is just not religion. I guess right now it’s an immediate for us to kind of come together and make sure we have… I wish there was more and more cooperation in that. Just like European Union, we don’t have a strong union like that in South Asia. And I wish we could have that more. And that would really make things very much easier. Because these droughts and these natural disasters cuts boundaries more than anything, and we need more cooperation.

Manda: Okay, so what springs for me in that, is suppose the SDR tokens could be used in a way that would promote the together, the gandhi neurones and less of the Palaeolithic brain. Because it is in the end down to people wanting to hoard resource because they feel resource is scarce. At the point when people feel there is abundance, then we become much more prosocial. And I wonder if we can create that sense of abundance with the tokens? That should be part of our inquiry. So we are heading for the end. But I think you had something that you wanted to say in closing, did you?

Saurav: Yeah. When you ask this interesting questions at the end of every podcast, I listen to a couple of years where you say if there is a teenager or young person or someone who you would like to kind of share a few things that they can do right now to help. And then I and I pondered over that question because I get asked this a lot, and I think I want you to kind of maybe share one thing, and especially if you’re young. I am very young. I’m only 26. But but if you are 16, 15. The first part is, I think it really helped me as well while I was going through teen age and trying to decide what I want to do with my life, is when you are interested or there are things that catches your attention and it draws you, there is a pull. You have to get close and proximate to it and look at the people who are essentially affected by it. So when I came to this country, I wanted to understand, I guess, just transition and the lives of the workers in the oil industry. And I met David from Aberdeen and he told me about his life in working in these oil rigs and in ship. And it really helps you understand at the heart of the problem because when you meet someone, just one person, something changes in your heart. So get proximate.

Saurav: And it has happened all through. When I was in Dhaka, I met fishermen and I know their names, their daughters names and it changes you. So, so, so get proximate, be it mental health, be it women’s rights, LGBT, whatever. Doesn’t matter, get proximate. Be it music if you want music, get proximate, right. The second one is is quite a funny one. It’s be young. Don’t let any crisis take away your childhood, be it a genocide, be it political oppression, be it climate crisis. No crisis is more important than your childhood. So live that and you don’t want to be a 30 year old thinking I left my childhood behind. So go, do the fun bits. And I learned this when I was in Dhaka and there was a genocide happening in Myanmar when people were being afflicted, the Rohingyas were coming to Bangladesh and I happened to be in that site. And what caught my attention was the people, the Rohingya, the refugees. Every evening they would play a sport together and they would just laugh and cheer. And even after they’ve seen some of the most horrifying things. They never let the sports go. They would play a kind of like a volleyball that would play with their legs. And that was just something so fun to kind of watch. So be young, be foolish, and do all the funny things that every young person does. Don’t, don’t, don’t be adult because that’s not inspiring.

Saurav: Be Young is very inspiring. So so your existence in itself is inspiring. So that’s the second one. And the third one. This is a challenge for anyone who’s listening. Create regenerative spots or places. If you think you belong to a neighbourhood, create something that you think is an aspect of regenerative future. You don’t get inspired by listening to someone. You get inspired by witnessing or experiencing. And when you create these places, spots of what it looks like, be it a co-op of a farm or be it like an art exhibition or be it a documentary screening that you did or be it something which you felt was important for you and you wanted to share with your community. Create that and you will see how it changes people, and when people move, your work is done and when the heart moves, your work is done. And you can move on to the next, to create these regenerative spots. I don’t know how will you do it? That’s a challenge. You look up the definition of what regenerative spots means and how will you create that through your God given skill that you have. Be it art, music, talking, farming, anything, dance. But create those spots and I can tell you it will give you so much meaning and happiness than anything can give. So, yeah, be young, be proximate and create regenerative spots.

Manda: That’s amazing. So many good ideas. Thank you so much. And I sincerely hope you get to COP 27 and are able to ask the questions that need to be asked. Thank you.

Saurav: Thank you. Thank you, Manda. This is such a lovely conversation and I hope to see you again very soon.

Manda: And that’s it for another week. Enormous thanks to Saurav for all of the inspiring work and the depth of the thinking that goes behind it. The idea of these SDR as global tokens, not debt related, feels to me genuinely radical and genuinely evolutionary renaissance creating. Whatever it is that we’re going to call this movement that we want to create. That is not a revolution because we don’t want to keep going round in the same spot. But that moves us all through to perhaps a more Gandhian perspective on the world, where we can all flourish. That genuinely was a truly inspiring conversation, and I hope you found it so too. And particularly Saurav’s three ideas at the end of stay young, play, get proximate to the people that you want to understand and then create something regenerative in your own community. Really glorious, fantastic ideas to carry forward. So that’s your job for this week, people. Go forth and be regenerative.

You may also like these recent podcasts

Roots to Health – building Food Resilience with Daphne du Cros of the Shropshire Good Food Partnership

We all know by now that plants grown in living, thriving, life-filled soil, give us living, thriving, life-filled food… but the steps to getting there in the face of a multinational industry devoted to toxic, nutritionally empty, addictive – and highly profitable – ultra-processed ‘food-like substances’ are harder to see…

Dance of the Spiritual Warrior: Balancing Love and Power with Jamie Bristow

What does it mean to (re)orient our entire culture around the power of love? To answer this, we have to understand the nature of love and of power and how both of these have many meanings in our culture, some of them essential to moving forward – and some of them so toxic they turn the entire concept into a poisoned cue.

The Magic of Darkness: learning to love life in the night with author Leigh Ann Henion

Do you love the dark? Do you yearn for sunset and the amber glow of a fire with the night growing deeper, more inspiring all around you? There’s a world out there of sheer, unadulterated magic that is only revealed when we put aside the lights and the phones and the torches and step out into the night – as this week’s guest has done.

Starting in the Ruins: Of Lions and Games with Crypto-Advocate and Changemaker Andrea Leiter

This week’s guest, Andrea Leiter is one of those polymaths who brings not just breadth, but astonishing depth to the work of bridging the worlds of technology, biodiversity and international law bringing them together in service of a new way of being built from the ruins of collapse.

STAY IN TOUCH

For a regular supply of ideas about humanity's next evolutionary step, insights into the thinking behind some of the podcasts, early updates on the guests we'll be having on the show - AND a free Water visualisation that will guide you through a deep immersion in water connection...sign up here.

(NB: This is a free newsletter - it's not joining up to the Membership! That's a nice, subtle pink button on the 'Join Us' page...)